-

You have never purchased a home before or

-

You have recently experienced a breakdown of a marriage or common-law partnership or

-

You did not occupy a home that you or your current spouse or common-law partner owned in the last 4 years or

-

One individual in the couple has never owned a home

The Government of Canada has 2 programs aimed at helping you afford a home:

1.The First-Time Home Buyer Incentive is a shared equity mortgage. It aims to help first-time homebuyers without adding to their financial burdens. There are no additional monthly payments.

How to qualify for the incentive:

-

Be a first-time homebuyer

-

The participants have a combined qualified annual household income of $120,000 or less.

-

The participant's insured mortgage and incentive amount cannot be greater than four times their qualified annual household income.

-

Participants must meet minimum insured mortgage down payment requirements.

With this incentive, the Government of Canada provides:

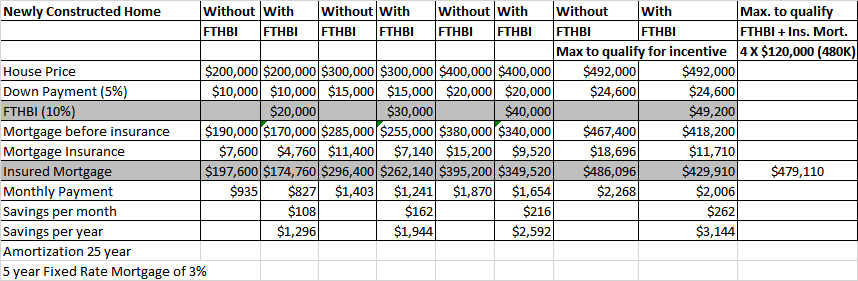

5% or 10% for a first-time buyer’s purchase of a newly constructed home

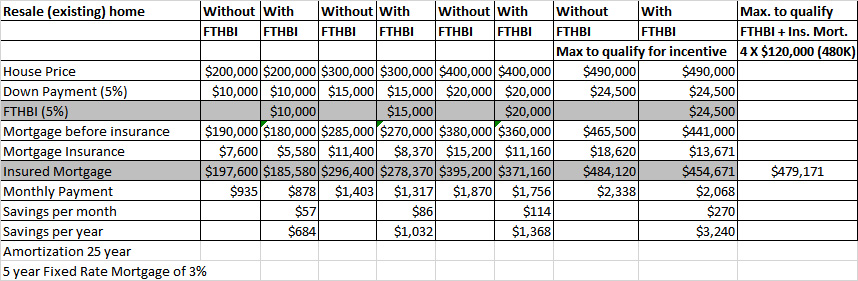

5% for a first-time buyer’s purchase of a resale (existing) home

5% for a first-time buyer’s purchase of a new or resale mobile/manufactured home

How much can you save?

5% for a first-time buyer’s purchase of a resale (existing) home

5% for a first-time buyer’s purchase of a new or resale mobile/manufactured home

How much can you save?

How is repayment calculated?

Using the incentive means that the government will share in both upside and downside changes in the property’s value.

If a homebuyer receives a 5% Incentive, the homebuyer will repay 5% of the home’s value at repayment.

If a homebuyer receives a 10% Incentive, the homebuyer will repay 10% of the home’s value at repayment.

The first-time homebuyer will be required to repay the Incentive amount after 25 years or when the property is sold, whichever comes first. The homebuyer can also repay the Incentive in full at any time, without a pre-payment penalty.

If a homebuyer receives a 5% Incentive, the homebuyer will repay 5% of the home’s value at repayment.

If a homebuyer receives a 10% Incentive, the homebuyer will repay 10% of the home’s value at repayment.

The first-time homebuyer will be required to repay the Incentive amount after 25 years or when the property is sold, whichever comes first. The homebuyer can also repay the Incentive in full at any time, without a pre-payment penalty.

Ex: Anita and John bought their first home (new construction) for $400,000.

They saved $20,000 for a down payment (5%)

They received $40,000 from the First-Time Home Buyer Incentive in a shared equity mortgage (10% of the cost of a new home)

As a result, Anita and John saved $216 per month which equates to $2,592 per year

10 year later they sell their home for $420,000

The incentive needs to be repaid as a percentage of the home’s current value:

10% of $420,000

Anita and John need to repay $42,000 or ($2,000 more than originally received)

They saved $2,592 x 10 years = $25,920

Extra fees:

There may be additional legal fees when selling your home since 2 mortgages are being closed.

The home may need to be assessed to determine the fair market value of your home.

When refinancing your first mortgage or switching your mortgage to a new lender.

2. Home Buyers’ Plan (HBP) is a program that allows you to withdraw up to $35,000 (recently changed from $25,000) in a calendar year from your registered retirement savings plans (RRSPs) to buy or build a qualifying home for yourself or for a related person with a disability. Therefore, the total amount that can be withdrawn is $70,000 in the case of a couple.

To qualify you must be considered:

- You must have a written agreement to buy or build a qualifying home for yourself

Qualifying home – a qualifying home is a housing unit located in Canada. This includes existing homes and those being constructed. Single-family homes, semi-detached homes, townhouses, mobile homes, condominium units, and apartments in duplexes, triplexes, fourplexes, or apartment buildings all qualify. A share in a co-operative housing corporation that entitles you to possess, and gives you an equity interest in a housing unit located in Canada, also qualifies. However, a share that only provides you with a right to tenancy in the housing unit does not qualify.

Repayment:

-

Starts the second year after the withdrawal of the funds (or sooner).

-

You have up to 15 years to repay the amount withdrawn from your RRSP.

Sources:

Post a comment